ESG & ESG Reporting

What does ESG stand for? What is ESG reporting? A Bothering Duty or a Sustainable Competitive Advantage?

WHAT IS SUSTAINABILITY?

Sustainability is a long-term strategy to keep the consumption of resources lower than the possibilities of regeneration.

This means adapting the behaviour in the present without limiting the future of coming generations.

Thus, for (entrepreneurial/political, etc.) decisions the criteria “economically efficient”,

“socially just” and “ecologically sustainable” must be taken into account.

This leads us to ESG.

What is ESG?

“ESG” stands for Environmental, Social and Governance and describes a set of rules for evaluating the sustainable and

ethical actions of companies. ESG originates from Corporate Social Responsibility (CSR) and sums it up in concrete figures.

Some examples are:

Environment (E)

// Water consumption

// Total gas emissions

// Energy use

Social (S)

// Occupational safety

// Diversity

// Demographic change

Governance (G)

// Corporate governance

// Values

// Compliance

ESG criteria

ESG criteria (Environmental, Social, and Governance) are playing an increasingly significant role in evaluating companies and investments. These criteria not only consider financial performance but also take into account how companies address environmental concerns, social aspects, and corporate governance.

Over time, ESG criteria have expanded from initially focusing solely on environmental sustainability to encompassing a comprehensive framework that includes social justice, labor practices, human rights, and ethics.

Companies that continuously consider and broaden their application of ESG criteria demonstrate a clear commitment to responsible actions and contribute to creating a more positive future.

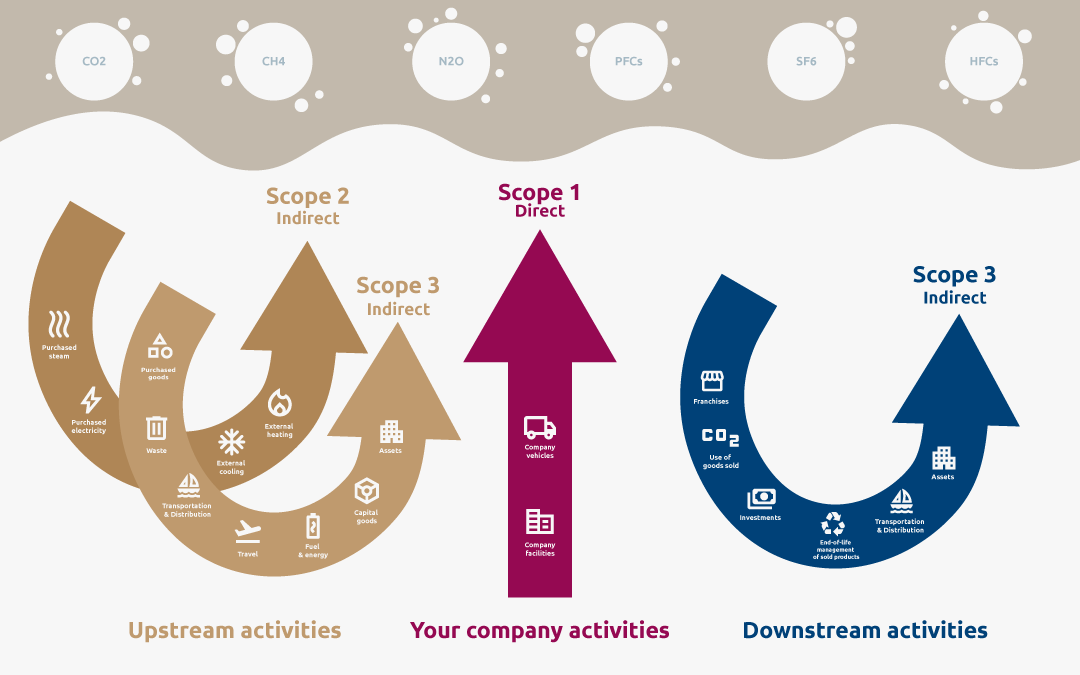

Greenhouse gas emissions: An overview

Greenhouse gases such as carbon dioxide (CO2), methane (CH4) and nitrous oxide (N2O) are mainly released by human activities such as industrial production, agriculture and transportation: they contribute significantly to global warming. Understanding our emissions and ways to reduce them is therefore essential for a more sustainable and environmentally friendly future.

SCOPE 2

Indirect emissions

Definition:

This category includes indirect emissions from the generation of electricity, heat or steam purchased and consumed by a company.

SCOPE 1

Direct emissions

Definition:

Direct emissions arise from sources owned or controlled by a company or organization. This includes emissions from company-owned vehicles, factories or heating systems.

SCOPE 3

Other emissions

Definition:

Scope 3 emissions are the resulting emissions from a company’s entire value chain, including emissions associated with purchased materials, the manufacture of products, the transportation of goods and other external activities.

Planet

Responsibility

Goal

A COMMON GOAL FROM DIFFERENT PERSPECTIVES

CUSTOMERS

Consumer needs, expectations and purchasing decisions have changed. There is a particular focus on “sustainable products” with honest transparency for instead for the materials used and their origin; the avoidance of waste; the use of recyclable packaging, etc.

Greenwashing is not a solution and a sustainability report can deliver real added value here.

PURCHASING / SUPPLY

Interest in the sustainability of companies in the upstream and downstream supply chain is increasing massively (keyword: product carbon footprint), as suppliers influence their own sustainability.

As a result, companies can also be indirectly affected by the new legal requirements for sustainability reporting, even if they do not actually fulfill the specified criteria for mandatory reporting.

EMPLOYEES

Sustainable companies with a tangible external impact are more attractive to the labor market and can score points in the “war for talents” with valuable ESG advantages.

LEGISLATIVE

The new legal obligations for sustainability reporting will be extended to companies via the Corporate Sustainability Reporting Directive (CSRD). The requirements will not only affect large companies or groups, but also medium-sized enterprises.

BANKS

When granting business loans, banks, more often will consider sustainability track record for their investment as they also want to be viewed in a positive light to their current and future customers.

This can lead to investments (e.g. in high-emission machinery) failing or to demonstrably sustainable companies receiving improved credit terms.

IMPORTANT INFORMATION ON THE TOPIC

OF ESG REPORTING

What is esg reporting?

ESG (Environmental, Social, and Governance) reporting is a robust framework that empowers companies to transparently disclose their efforts towards sustainable and responsible practices. It goes beyond mere financial performance, delving into the core aspects of environmental impact, social responsibility, and effective governance.

ESG reporting enables businesses to showcase their commitment to addressing global challenges, such as climate change, diversity and inclusion, and ethical decision-making.

By adopting ESG reporting, companies exhibit a powerful dedication to creating a positive impact on the planet, society, and long-term business success. This dynamic approach not only fosters trust among stakeholders but also positions businesses as champions of change in the pursuit of a better, more sustainable world.

WHO IS AFFECTED BY THE REPORTING OBLIGATION?

CSR directive Implementation Act (Non-Financial Reporting Directive; NFRD) | EU directive on sustainability reporting (Corporate Sustainability Reporting Directive, CSRD) | |

| When | Since fiscal year 2017 | With fiscal year 2024, 2025, 2026 |

| Who | a.Capital market oriented or banks, insurances, Investment companies independent or listed b.> 500 employes and ~ 500 businesses in Germany indirect impact possible! | a.Capital market oriented (also SMB!) or fulfill two of the three following criteria b.> 250 employees c.Revenue > 40 Mio € d.Total Assets > 20 Mio € ~ 15.000 businesses in Germany ~ 50.000 businesses in Europe |

| Where | Management report or separate sustainability report | Management report with digital tagging |

| What | Non-Financial information + Comply or Explain | dual materiality + “green” financial key figures of taxonomy regulation, supply chain // mandatory ESG key figures |

| Framework | Freely selectable, specify framework. If without framework: Justification necessary | EU sustainability standards (developed by the European Financial Reporting Advisory Group) |

| Audit | just existence | of content |

| Deadline | Publication within 4 months of balance sheet date | no separate publication necessary |

ESG Reporting

what are the challenges?

YOU NEED THE REQUIRED DATA!

Data availability

Your Enterprise Resource Planning (ERP) system is the number one source of data, because it controls and integrates the core business processes in your company. However, a lot of data is not yet available because there has been no reason to explicitly collect ESG relevant data so far.

Risk assessment

Sustainability reporting also requires a comprehensive risk assessment on sustainability risks. This also entails new tasks and challenges for your company’s risk management.

Data quality

For sustainability reporting, various data from different departments must be collected and compiled. Quality differences in the data can lead to inaccurate reports

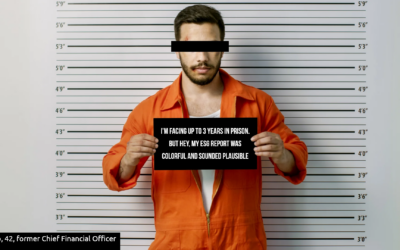

and thus to incorrect presentation (cf. §331 HGB*).

*The German Commercial Code (HGB) contains most of the German laws on annual financial statements, and reports, as well as special regulations for insurance companies, banks and cooperatives.

Measurability

Another challenge in sustainability reporting is measuring aspects of sustainability for the first time. This is made more difficult when data is available but it is not clear whether its quality meets the high requirements.

Complexity

Sustainability is much more than simply producing reports. Sustainability starts with the planning of innovations and must take into account the entire life cycle of products and services. It demands a change in thinking for which your company must define the guard rails.

Stakeholder involvement

You need to involve your stakeholders in your sustainability strategy. This is the only way you

can ensure that all relevant stakeholders and

their concerns and expectations are

adequately taken into account.

What can you already do now?

THE CLOCK IS TICKING. PREPARE YOURSELF

AND YOUR SAP SYSTEM WELL!

01

Inform

Gather information whether and to what degree your organization has to comply with the reporting obligations.

Talk to your auditor/financial advisor!

Actual analysis

Create clarity about the ESG data As-is situation in your company with the help of an ESG analysis. A preparation analysis shows you how well prepared your data is for the EU standards.

Processes benefit

Leverage the capabilities of your ERP system and use standard processes that can simultaneously generate and collect ESG data.

04

Reporting

With the data collected, you are in a position to create a resilient ESG report. Your auditor must be able to certify the content of the report.

News and publications about

ESG & ESG REPORTING

Corporate Sustainability Due Diligence Directive (CSDDD): A new era for sustainable supply chains

What is the CSDDD (Corporate Sustainability Due Diligence Directive)? The Corporate Sustainability Due Diligence...

Supply Chain Due Diligence Act – Everything you need to know about the LkSG

What is the Supply Chain Due Diligence Act (SCA) and why is it so important? The German Supply Chain Due Diligence Act...

THE SCARCE RESOURCE HALLOWS

THE SCARCE RESOURCE HALLOWS How do I manage to master the continuously growing complexity of technological...

Understanding Greenhouse Gas Emissions: Explaining the Scopes

Introduction Greenhouse gas (GHG) emissions are at the forefront of global discussions on climate change. These...

ESG Reporting for SAP systems: A Comprehensive Guide

Introduction: The importance of ESG Reporting In today's business world, ESG Reporting - reporting on environmental,...

ESG vs CSR: Navigating the Path to Responsible Business Practices

ESG vs. CSR: The Differences Corporate responsibility and ethical business practices are essential. Two approaches in...

Unlocking the Hidden Potential: Unveiling the Power of Your SAP Ecosystem

In the lively and ever-evolving world of SAP systems, where complexity reigns and processes span vast landscapes,...

From counselor to probation officer

1 Sustainability becomes a sustainable competitive advantage A Sustainable Competitive Advantage according to Porter...

Understanding Carbon Footprint: Impact, Examples, and Reduction Strategies

Introduction The carbon footprint has become a key metric for environmental impact - not only at the individual level,...

The Power of Corporate Social Responsibility and Development (CSRD): Driving Sustainable Business Success

In today's interconnected world, companies are increasingly recognizing the importance of Corporate Social...

Greenwashing keeps you dirty

„Tu Gutes und rede darüber“ (literally translated: „Do good and talk about it“) – the title of the work published by...