1 Sustainability becomes a sustainable competitive advantage

A Sustainable Competitive Advantage according to Porter does not consider „sustainability“ in terms of ecological or social orientation, but sees it as a company‘s ability to be successful in a sustainable way – in the sense of long term. This can even have legal consequences, but more on that later.

Dealing with the issue of „sustainability“ itself has now become a factor critical to sustainability success or even a competitive advantage, because the requirements of the various stakeholders have changed fundamentally. To list just a few examples:

Customers

Consumers consider „sustainable products“ with transparency regarding the materials used and their origin when making their purchasing decisions. In addition, the avoidance of waste or the use of recyclable packaging is a particular focus.

Suppliers

As suppliers help to influence the sustainability of their own company, interest in the sustainability of companies both upstream and downstream in the supply chain is increasing (keyword: product carbon footprint).

Employees

Sustainable companies with an outwardly perceptible image are more attractive to the labor market and can score points in the „war for talent“.

Banks

When granting loans to companies, banks are more restrictive with regard to sustainability criteria for the investment. This can lead to investments (e.g. in high-emission machinery) failing or to demonstrably sustainable companies receiving improved credit terms.

Legislator

Legislation requires that sustainability aspects be taken into account in corporate decisions; at the same time, companies are obliged to be transparent by regulatory requirements.

Consequently, it is no longer sufficient to focus on partial aspects in connection with sustainability: Instead, a holistically conscious or strategic rethinking is required to transform the company into a measurably sustainable enterprise.

The sustainable transformation and the increased obligations associated with it (especially in connection with sustainability reporting) hold great potential for consulting, because the uncertainties within companies are enormous. The consultant can provide useful support here by creating facts about the status quo and deriving next steps based on them. What are the current regulatory requirements and what do they mean for the consulting industry and the associated market potential?

2 Same Customer, Different Business?

The European Commission‘s Corporate Sustainability reporting Directive (CSRD) extends reporting requirements in the area of sustainability. In connection with this, the companies concerned must publish standardized key figures in the company‘s management report. These obligations will apply from the 2024 financial year for capital market-oriented companies and for companies with more than 250 employees, a total balance sheet total of more than 20 million euros and/or sales of more than 40 million euros.

This will affect around 15,000 companies in Germany and around 50,000 companies in Europe. In addition, the content of the sustainability report to be published must also be certified by external auditors as part of the annual audit. Accordingly, the consulting market consists of the companies affected by the reporting obligation. However, there will also be a need for support in the auditing sector to ensure that the audits are carried out efficiently.

The content to be published in the sustainability report is preceded by a materiality analysis. The indicators to be determined relate to the complex topics of Environment, Social and Governance (ESG).

At the same time, the EU sustainability standards require that ESG risks are also given adequate

consideration. In this context, the principle of double materiality is important: What do sustainability risks mean for the company („outside-in view“) and also the mutual perspective: What does the company‘s behavior mean for the environment („inside-out view“)?

The binding nature of reporting on the topic of sustainability thus moves to the level of

financial reporting, or to put it another way:

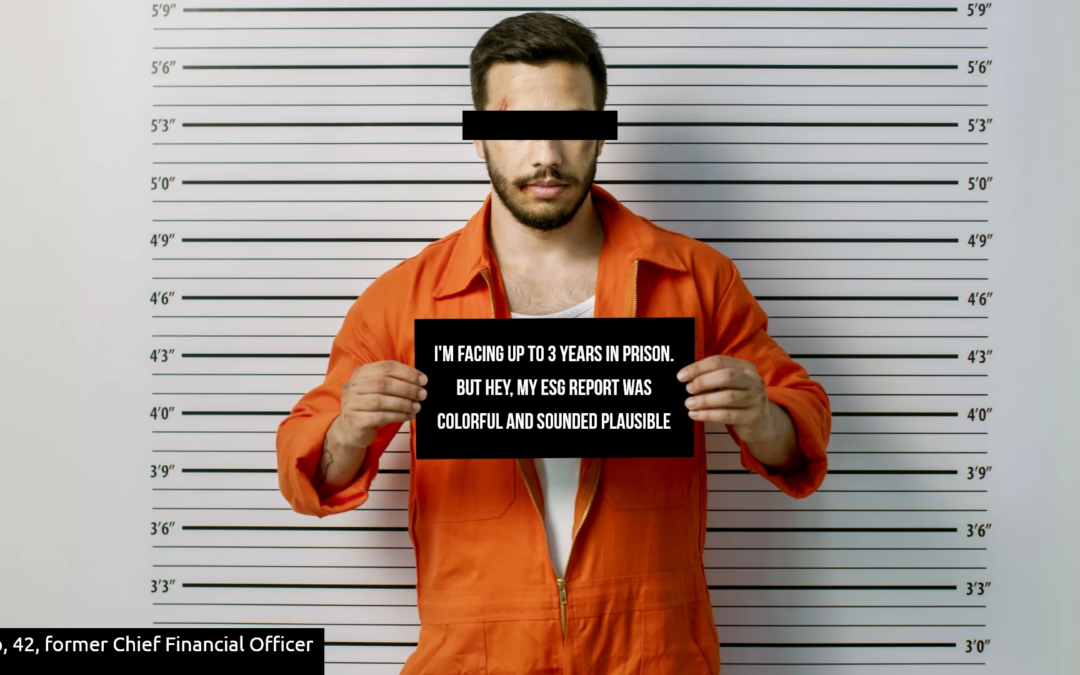

In Germany, greenwashing is even elevated to the level of accounting fraud!

So one may well ask what consultants and probation officers may have in common? The same clientele, because:

„Any person […] who, as a member of the body authorized to represent a corporation or of the supervisory board of a corporation, misrepresents or conceals the circumstances of the corporation in the opening balance sheet, the annual financial statements, the management report including the non-financial statement […] shall be liable to a custodial sentence not exceeding three years or to a monetary penalty.“ (Section 331 (1) no. 1 German Commercial Code).

3 What are the challenges?

Current studies show that the challenges for companies are enormous in order to meet the requirements of the legislator. Central to reporting companies is the collection of qualitative and reliable data, as well as its processing and analysis. This is further complicated by, among other things:

// the rapid timetable (the sustainability report for fiscal year 2024 assumes that the necessary data will already be collected in fiscal year 2024),

// new roles and responsibilities to be created, or

// new resources and competencies to be built up in the company.

The liability issue as well as the required and content-oriented auditor‘s certificate further increase the pressure on companies.

Ultimately, the required data is the key to the success of all efforts, because insufficient data quality is reflected in the quality and, consequently, the resilience of the sustainability report.

4 But where is the data?

A comparatively „simple“ way of acquiring ESG data is to analyze financial documents (e.g. invoice receipts) and process them further using familiar spreadsheet software to calculate greenhouse gas emissions, for example. On closer inspection, however, it becomes clear that

// the leading unit is not euros or dollars, but kilowatt-hours, tons or liters;

// a variety of different data sources is required;

// manual processing activities are subjective, slow and error-prone, and in view of the required commitment: risky and expensive!

A company‘s Enterprise Resource Planning (ERP) system acts as its central software-based control system and integrates – ideally – all core business/logistics processes. Thus, a company‘s ERP system is the data source for sustainability reporting or is predestined to become one. In reality, however, this data is not yet fully available in the ERP systems because a large amount of this data has not been relevant to business activities to date.

In order to get to the root of the problem, the company‘s ERP system must be configured in such a way that all the necessary data can or must already be recorded when work is performed. For example, when transport documents are recorded, information on the weight of the goods, means of transport, transport service provider and distance can also be taken into account. This data is needed to determine the pollutant emissions when transporting the goods to the customer, and at this point, at the latest, it becomes clear that the sole analysis of

invoices is not expedient.

The support potential of an ESG consultant thus goes much further. In addition to expertise in ESG regulation, sound system and process knowledge is also required. IBIS‘s ESG Preparation Analysis provides support for this.

5 IBIS helps with data availability and quality

By using the ESG Preparation Analysis, the data quality in the company‘s SAP ERP system is compared with the requirements of the ESG standards. This shows how the company is positioned in regard to the respective requirements. At the same time, such a usage analysis transparently reveals whether the data required for the analysis is maintained in the system at all or which data still needs to be maintained in order to be able to determine meaningful sustainability key figures based on it.

The individual areas of analysis with a focus on reviewing ESG data availability and quality include:

Organizational Structure

Overview analysis on overarching aspects e.g. business activities in different countries with different stakeholders.

Material Flow Analysis

Where are which materials purchased? Which materials are processed in the company and how, and where are processed materials delivered?

Energy

What energy is purchased and how is it used in the company? How are resources allocated to individual business processes?

Waste

How does the company deal with waste and hazardous goods in the disposal environment?

Water

Where in the company is water or materials that indicate water used? Is data maintained that allows geospecific mapping?

Packaging

Are packaging/packaging materials used and in which processes? Are units such as weight/volume maintained?

Transport

How are finished products and goods transported to the customer? Are there transport documents for the deliveries and do the transport documents contain ESG-relevant information (e.g. distances, transport weight, means of transport, etc.)?

Vehicle Fleet

Does the company operate a vehicle fleet? Is ESG-relevant data (e.g. fuel type, vehicle category) maintained?

Business Trips

Do business trips take place and are ESG-relevant data correctly maintained? From where to where do employees travel? Which means of transport are used?

Employees

To what extent are employee master data maintained with regard to sustainability requirements?

Accident and Safety Management

Are data on occupational accidents and safety aspects maintained?

The ESG Preparation Analysis in a nutshell

The ESG Preparation Analysis in a nutshell

With the analysis as a starting point, a valid status quo is created for further implementation steps, which can then be successively addressed. Through the parameterized adaptation of system processes, transforming companies benefit not only in the short term, but also sustainably (in the sense of permanently).

The improved availability of data or its quality now allows the company to create a valid sustainability report. Valid data availability and quality is a prerequisite for the use of reporting tools based on it (e.g. SAP Sustainability Control Tower or similar), because the quality of the report stands and falls with the quality of the data included in it. The garbage-in/garbage-out effect is well known.

The reconciliation of SAP system and ESG standards results in a resilient answer about the status quo and the next target-oriented action items for consultants and clients. The ESG Preparation Analysis is, so to speak, solid as a rock in the turbulent waters of regulatory dynamics. It is the basis for expanding consulting in terms of thoroughness, quality and speed and provides support on the way to the new era of smart consulting.

This eliminates the risk of inadvertent misrepresentation and, consequently, spares the counselor the undesirable career of becoming a probation officer.

An article by

Dr. Markus-Alexander Kötzle